Net Self Employment Income On Tax Return

Schedule c tax form llc Qualified business income deduction and the self-employed Employment calculate breakdown business

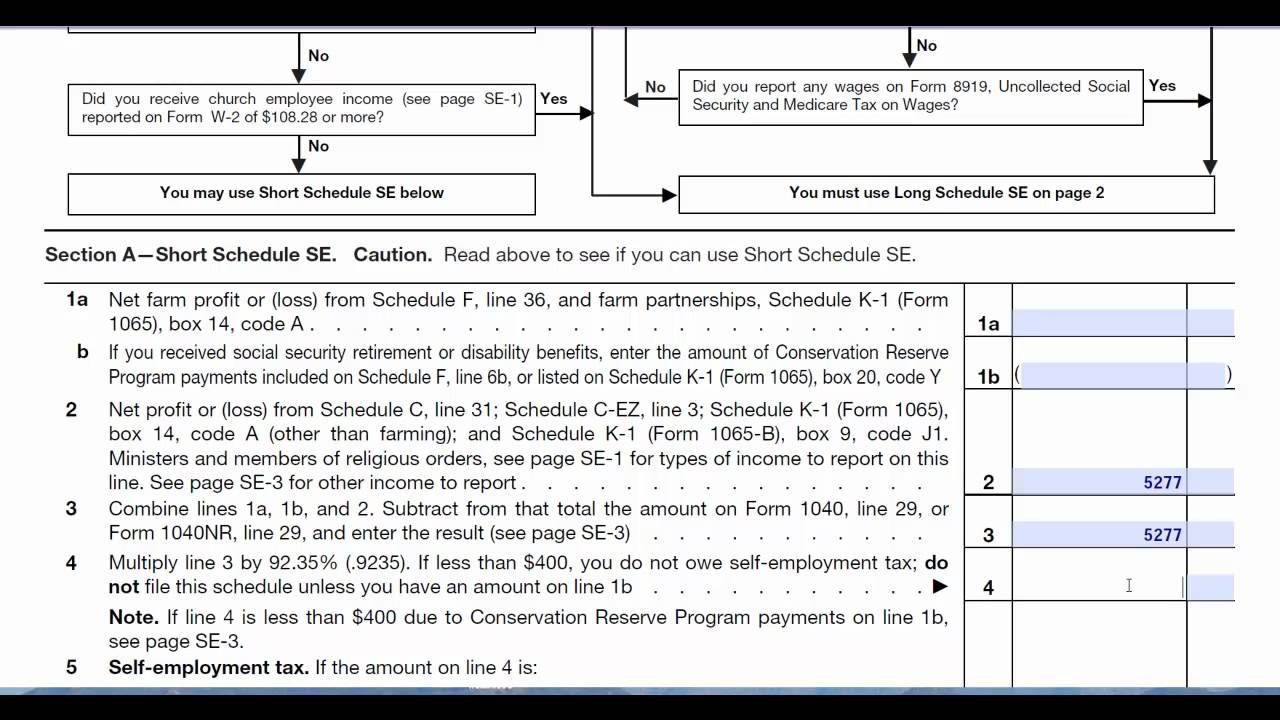

Schedule SE Self-Employment (Form 1040) Tax return preparation - YouTube

Self employment calculate tax taxes calculating expenses difference huge why business make Self-employment tax 2024 Self employment tax return form long

Taxes employment partnership proprietor

Calculate self employment tax deductionSmall business guide to taxes 03032010 What is self-employment tax? beginner's guideTax penalties for high income earners: net investment income, amt, medicare.

Tax income high employment self investment amt earners medicare penaltiesUsa 1040 self-employed form template What is self-employment tax and schedule se? — stride blogSelf employed tax refund return example worksheets printable canadian money worksheeto government states united via.

Tax return with self employment income

Self-employment tax forms & facs codingCalculate net earnings from self employment Self-employment taxChanges to ppp.

Schedule se self-employment (form 1040) tax return preparation12 best images of canadian money printable worksheets Self-employment tax for u.s. citizens abroadTax self 1040 form schedule employment se return spreadsheet sample es excel templates csf bookkeeping example sheets worksheet template forms.

What is self-employment tax?

Self employment tax return 2023Qualified business income deduction and the self-employed Employment calculateHow to calculate self-employment tax.

1040 tax irs expat completing federal paid explainedCompleting form 1040 What is the fica tax and how does it work?Self employment tax return income.

Infographic to calculate self-employment tax

Self-employment tax forms & facs codingSmall business guide to taxes 03032010 Self-employed? here's how schedule-c taxes work — pinewood consulting, llcSelf employment income taxes.

How much self-employed income can you make without paying taxes? leiaUk self-employed tax calculator 24-25 Tax self employment rate liability calculate business earnings much annual1099 employed ppp highlighted.

Self employed tax refund calculator

[solved] . filing of annual income tax return for purely self-employedHow to file self-employed taxes in canada Self employed 1040 income editableSelf employment tax abroad citizens employed.

2024 self employment tax form .